No matter the fact that the investors in a Romanian company are residents or foreigners (or ventures), in both cases they are treated the same and benefit from the same opportunities of developing economic activities in Romanian. All entities operate as independents and are separate by their shareholders/partners' legal units, having their own patrimony, possessions, appelation, administration, registered capital, headquarters and bank accounts. In Romania, there are two types of companies: joint stock companies (S.A. - societate pe actiuni) and limited liability companies (SRL - societate cu raspundere limitata). In the case of a SRL, the foreign company can have sole ownership and hold all shares, while in the case of a SA, there must be at least two shareholders (private persons or legal entities). Still, the most commonly used legal form is SRL. All businesses must be registered at ONRC (the National Trade Register Office - Romanian Chamber of Commerce and Industry) and the corporation starts to exists since the date of registration. ONRC is a public institution that keeps statistical information of economic activities. The process of company incorporation in Romania states that every business must have at least a shareholder for a SRL and two for a SA. Additionally, one person can't be unique associate in more than one company. Shareholders can be either companies or individuals and can all be non-Romanians.

The SRL - limited liability company is a legal entity with one up to 50 associates. This business is based on foundation documents. Also those wanting to open a Romanian SRL Company must know that the mandatory registered capital of a limited liability company is minimum 200 RON. The SRL (limited liability company) falls under the regulations of Law 31/1990 and can have a maximum number of 50 associates that will answer in the percentage of their subscribed capital shared. Associates could be private persons or legal entities, but no entitiy can be a unique associate in more than one SRL and no limited liability company can be a unique assiciate to other SRL. read more...

In order for business owners to be able to develop their activities securely and legal, there are a few aspects related to VAT registration that must be clarifies. First of all, holders of companies must get well informed that they must met certain conditions if they decide to register for VAT, as provided by the VAT registration procedure. These conditions and indicators are very relevant from ANAF's point of view (National Fiscal Entity in Romania), in the process of evaluating and granting the VAT number after deciding if the company is not a fiscal risk. In consequence, companies that are obliged )by esceeding the fiscal value limit) or choose to register for VAT purposes, must submit all documents that are required in order to get their VAT number. read more

A branch is an extension of a mother company that has no independence or legal personality. Branches fall under the regulations of law no. 105/1992 that accepts international practice for branches that are governed by the law from the country in which the mother company is established. In order to set up a branch in Romania, first of all you need to register the business unit at the National Trade Registry. The parent company is completly liable for any of the managers/employees of the branch. The representatives can close contracts, even though the branch has no legal personality, but it has authorization to take actions in the name of the mother company. read more...

Having a virtual office Bucharest, for a Romania Company, you will get all the benefits of a high-profile office presence and pay way less that for a traditional office. We, at Darie, Manea and Associates, understand the business community nowadays. We are experienced in company formation activities and providing services related to virtual offices. read more

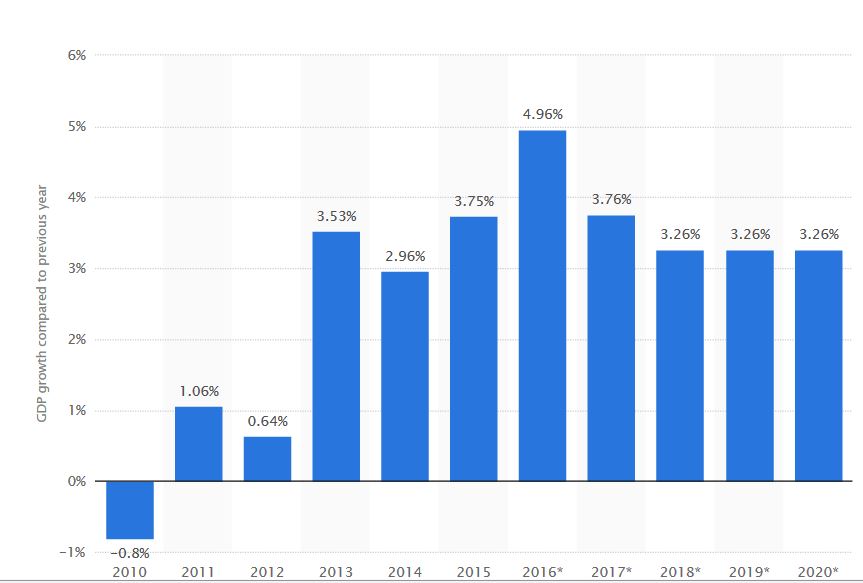

Romanian laws and regulations for micro-enterprises has changed in 2018 brining new benefits and advantages for these legal entities. For example, companies with a turnover under 1.000.000 euro will pay only 3% corporate tax (those with no employees) and 1% corporate tax (with one or more employees) and 5% tax for dividends. Romanian microenterprises have gone to several transitions and interpretations the past few years as the conditions that must be met to set up a micro-company have changed due to the changing economic environment - the main characteristic for countries with high economic development. To starts, with, you must understand the concept and definition, individuals that want to register a micro company in Romania should realize that a micro company is a sector of the limited liability legal form that meet specific guidlines and conditions. read more

If you represent a foreign company that is interested in opening a secondary office in Romania, there are plenty of options. The Romanian legal system provides two general different types, amongst many others. For instance, you can open a subsidiary to represent you in Romania. This type of company will be fully owen or controlled by your maind business entity (parent company or holding company). Still, it is a distinct company, that operates independently, offering advantages for taxation, law regulation and liability. read more ...

The Romanian Law Firm Darie, Manea and Associates, based in Bucharest, Romania has helped a large number of foreign investors in opening Limited Liability Companies, Joint Stock Companies, Branches and Representative Offices throughout Romania. One of our major activity is related to company formation Romania as well as additional services like accounting, virtual office and bank account openings complemented by internet banking.

We have incorporated more then 1.000 companies, branches or representative offices. Our Romanian Law Firm is acting on the Romanian market since 2006 as a competitive and active participant.

Our company has been chosen by foreign investors from all around the world due to professional services and a profound understanding of the Romanian market in regards to special business licenses, consultancy throughout company activity and tax law. We are also working with other respectable company formation agents from United Kingdom, Italy, USA and Russia. Our team of professional lawyers assists our clients throughout the entire process of registering company Romania. We are able to represent in front of any official authority in Romania being thoroughly familiar with the current economic conditions.